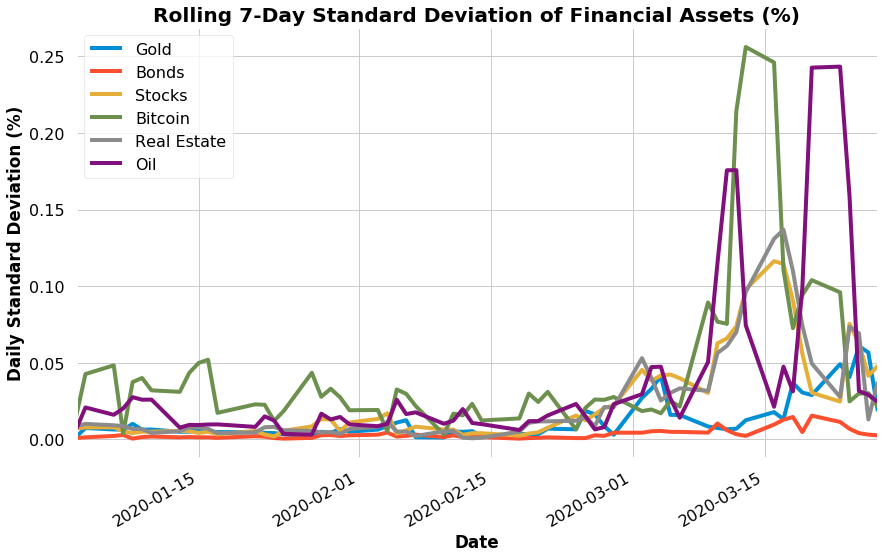

The coronavirus pandemic has sent global financial markets reeling since the beginning of March.

March 16 ranked the 3rd largest 1-day drop in the S&P500 ever. Since the beginning of the peak of the stock market in February, the S&P500 has been down ~30%.

Bitcoin, cryptocurrency, real estate, gold, and oil have not been spared either. All have recorded sudden price drops since the beginning of the year.

This article will analyze the movement of global financial markets and its correlation with Bitcoin during the COVID-19 crisis. We’ll consider the following sources as price measures for the following.

- Bitcoin price from Coinmarketcap

- Bond prices from Vanguard Total Bond Market Index

- Stocks prices from the S&P500

- Gold from the price of gold futures traded on COMEX

- Real Estate as Dow Jones US Real Estate Index

- Oil as the price of crude oil futures from WTI

All calculations are completed and credited to the author.

Standard Deviation of the Global Market Assets

Correlations Between Major Assets

Traditionally, many cryptocurrency enthusiasts have considered Bitcoin to be a safe asset, which would hedge their portfolio against global financial markets. This seems to have not been the case, as Bitcoin seems to have been heavily correlated with the US stock and real estate market.

Gold Has Not Fared Much Better

Risk-Adjusted Return

When we take a look at risk-adjusted return via a 21-rolling Sharpe ratio of different financial assets, almost every single asset has dropped during the crash. Bitcoin and stocks are the least performant from a risk-adjusted return perspective.

Does a portfolio of 80% stocks and 20% Bitcoin offer a better risk-adjusted return

If we look at the Sharpe ratio of stocks & bitcoin just during the beginning of March, then it is better to just have stocks in your portfolio during the crash.

But if you extend the timespan to all of 2020, then a portfolio comprised of stocks and Bitcoin would have yielded a better risk-adjusted return.

This is also true for a period spanning the last year.

So for those freaking out about the cryptocurrency crash as of late, try to have some perspective.

Greater Diversification with a Cryptocurrency Index

Compared to just holding Bitcoin, a portfolio of the top 30 cryptocurrencies by market cap was much less correlated to the general financial market, signaling the importance of diversifying your cryptocurrency portfolio beyond just Bitcoin.

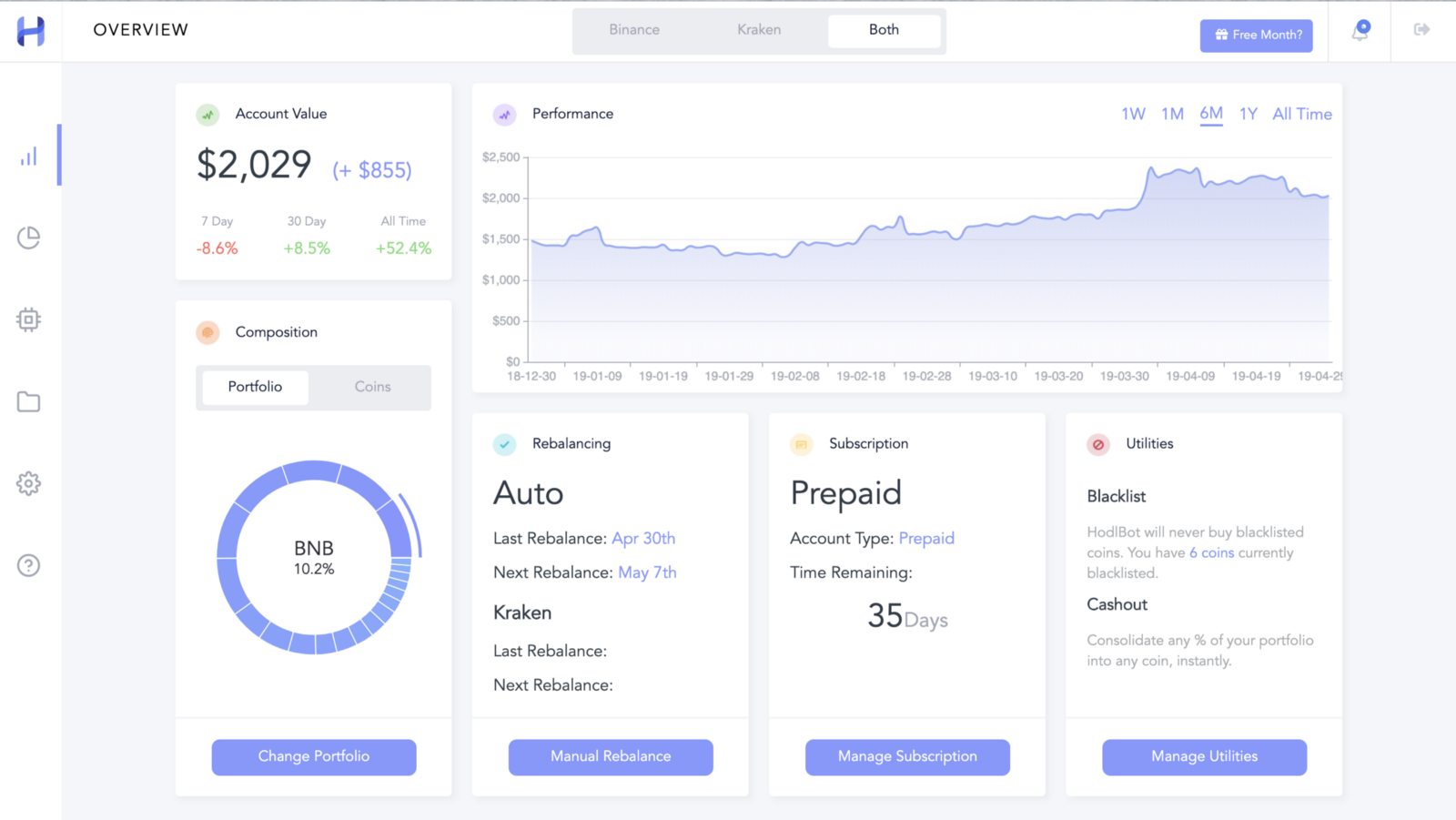

HODL30 index is a cryptocurrency index comprised of the top 30 coins by market cap, weighted by square root market cap. You can get this portfolio by using HodlBot.

Across the top 20, we do see instances where certain coins have low correlations with each other e.g. BTC & Vechain, Dash & Vechain, Ethereum-Classic & NEM.

Written by Anthony Xie

I’m the founder of HodlBot.

I’m a big data nerd. I like to talk about all things data, finance, and crypto. You can find me on Twitter here.

At HodlBot, we make it easy to automatically create diversified cryptocurrency portfolios.

We created HODL10, HODL20, HODL30 indices and the first ever application that allows you to create your own personalized cryptocurrency index fund.

To get started all you need is a

- Cryptocurrency Exchange Account

- $200 in any cryptocurrency