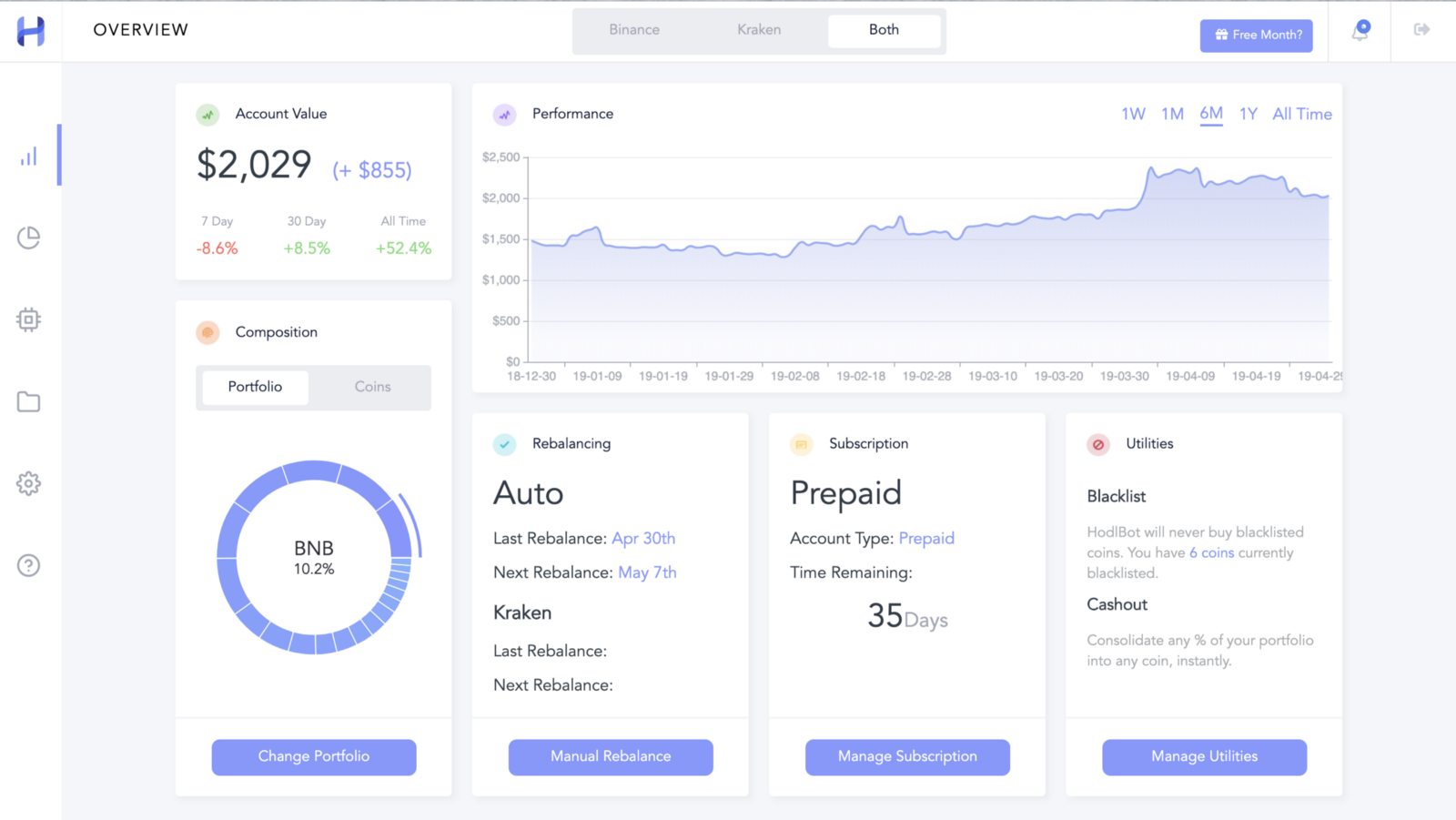

At HodlBot, we’re giving non-accredited investors an easy and inexpensive way to invest across the entire cryptocurrency market.

We don’t know who the winners will be, but we are confident that the price & value of the asset class will increase in the long-run. That’s why our investment philosophy is centred around passive indexing.

In March 2018, we launched the HODL20, an index comprised of the top 20 coins by market capitalization. While it was well-received, many of our users want to customize and give it their own flair.

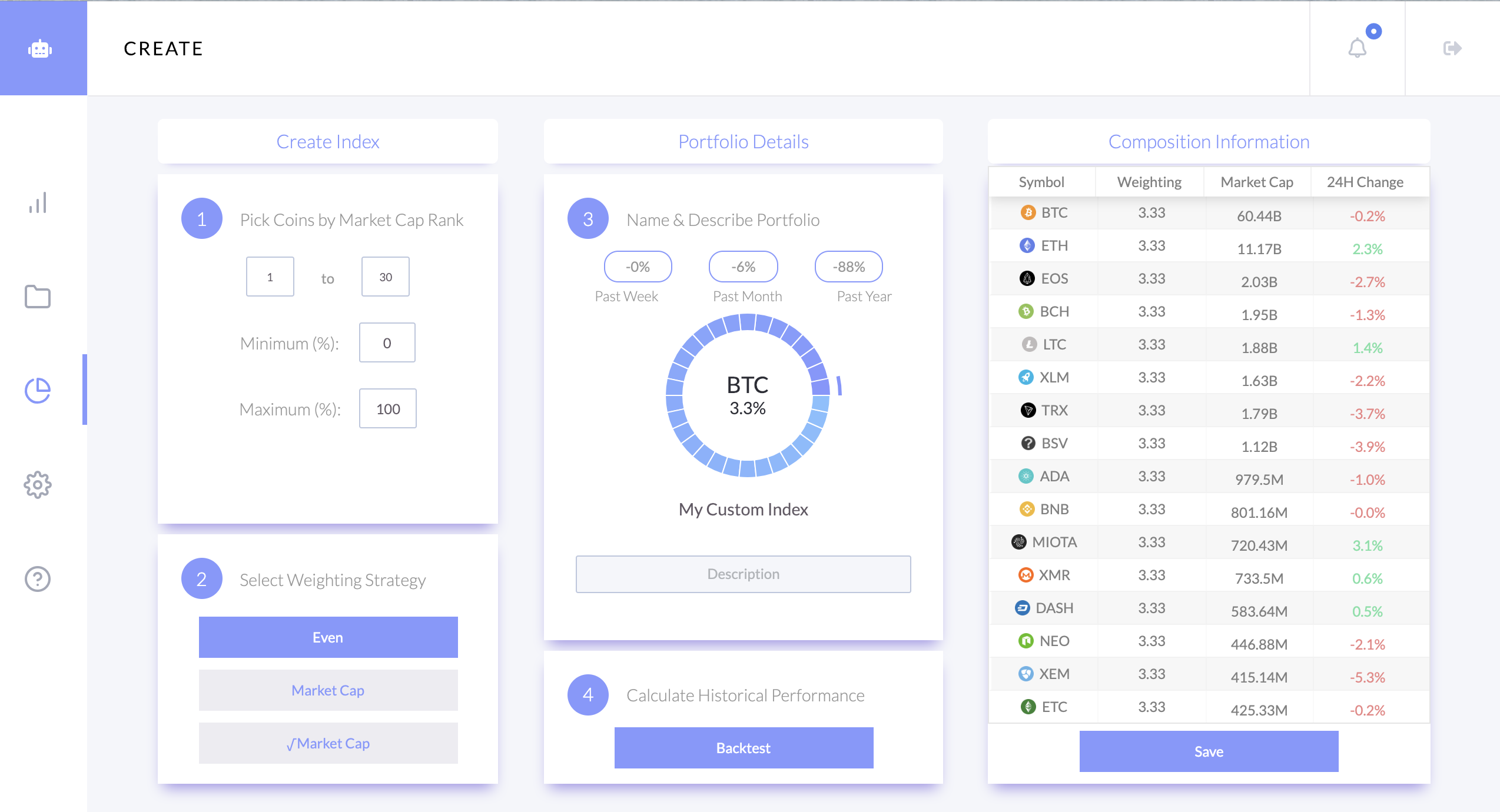

So today, we’re launching a new feature that lets anyone create their own cryptocurrency index. All you need is a Binance account.

Here’s how it works.

1. Choose the # of Coins in Your Portfolio & Set Percentage Caps

The first step involves selecting the # of coins that will go into your portfolio.

For example, ranks 1–20 capture the top 20 coins by market cap.

You can also create mid-cap and small-cap indices with different configurations e.g. 20–40, 80–100.

Select the top 20 coins by market cap. The maximum % of any coin in the portfolio is 10%

Since the cryptocurrency market is very top-heavy, the top 3 coins make up 80% of the market capitalization, you may want to give lower ranked coins a higher weighting. One way to do this is by using percentage caps.

A maximum cap denotes the maximum percentage any coin can be in your portfolio. Anything above a maximum cap gets redistributed to all the coins below by weighted market capitalization until the entire sum of the portfolio adds up to 100%.

Conversely, a minimum cap specifies the smallest percentage of any coin you can have in your portfolio.

2. Select a Weighting Strategy

Once you’ve selected the # of coins to include and determined your percentage caps, it’s time to select a weighting strategy.

There are three options.

- Evenly weighted — Every coin in the portfolio has equal weighting.

- Market capitalization weighting —Coins with larger market capitalizations are weighted more heavily. The percentage of any individual coin is the coin’s market capitalization value divided by the total market capitalization value of all the coins in the portfolio.

- Square root market capitalization weighting —The square root weighting strategy has a similar function to maximum percentage caps. Since the cryptocurrency market is top heavy, taking a square root of market capitalization shifts some of the weightings from the highest capped coins towards the lower-capped coins.

3. Backtest your Strategy

You don’t want to jump into your strategy blind. So after you’re done creating your index, it’s time to run a backtest against historical data to see how your portfolio would have performed in the past.

Fees and rebalances are taken into consideration for the backtest. For simplicity’s sake, we’ve scaled the backtest to start with a value of $1.

4. Save your Portfolio

If you’re happy with the results, you can save your portfolio & execute it right away. If you want to save it for later, you’ll see it show up under your saved portfolios. You can switch between any as much as you’d like.

5. Set your Own Rebalancing Period

When prices change, the allocations in your portfolio will shift out of place. A rebalance performs the buys & sells to get it back to the original allocation.

The default rebalancing period for HodlBot is 28 days. But you can customize to be whatever you like.

Some investors believe that more frequent rebalances are always better. Our research shows otherwise. On an after-fee basis, we believe anything between 7–90 days is appropriate.

6. Add Coins to your Blacklist

Some investors despise certain coins and want to exclude it from their portfolios. If you blacklist a coin from your portfolio, HodlBot replaces it with the next highest market cap coin.

That’s all folks. Thanks for tuning in.

Remember that you can try out HodlBot for the first 7 days for free. After that paid subscriptions start at $3/month.

If you’re not satisfied with indices and would like to create your own portfolio. Check out this sister article. I walk through how to create your own custom portfolio, and how to assign custom weightings.