This in-depth guide explains all the essential knowledge you need to know about investing in cryptocurrency. It will teach you the basics of portfolio management, diversification, rebalancing, and risk management.

We will approach this guide through a level-headed financial lens and dive into core topic such as:

- What are the different types of cryptocurrencies?

- How are cryptocurrencies priced?

- Where you should buy cryptocurrency with the best prices

- Reasons why you should (and shouldn’t) invest in cryptocurrency

- Passive investing strategies

- Active trading strategies

- The best portfolio tracking and portfolio management tools

- How to report cryptocurrency gains/losses during tax season

- Common lies & deceptions told by exchanges, trading experts, etc.

This is a living and breathing document that I will be updating every month. Please leave comments and feedback.

What Are the Different Types of Cryptocurrencies?

There are thousands of cryptocurrencies, 2,275 listed on coinmarketcap alone. Each cryptocurrency serves a different kind of purpose, but the majority of these coins fall into one of these four categories:

- Store of Value — Maintain purchasing power in the long run

- Digital Currency — Used for everyday transactions

- Utility Token — Used for redeeming a service/good

- Security Token — Tokenized representation of a real-world asset

Store of Value (SoV)

Bitcoin is a prime example of such a cryptocurrency.

The primary objective of SoV cryptocurrencies is to maintain purchasing power in the long-run.

SoV coins typically have a scarcity mechanism built into their protocol so that there is a hard limit on the money supply. As such, scarcity protects their value against wanton monetary inflation.

Note that SoV cryptocurrencies are usually not pegged to any real-world asset. The balance of demand & supply determines their price in the market.

While anyone can create an SoV cryptocurrency, the strongest ones out there own a vast network of buyers, sellers, and owners. Network effects are what make SoV cryptocurrencies defensible. The more people who hold SoV cryptocurrencies, the more demand, trading volume, and liquidity, there typically is.

2. Digital Currency

Digital currencies are designed for payments and transactions.

To be appropriate for everyday use, digital currencies must have low fees and low latency. Furthermore, the overall network needs to have high throughput and be able to handle a high degree of transactional volume.

The coffee rule: “If I can’t buy coffee with it, the fees are too high for day-to-day use”.

Many digital currencies also offer privacy as a feature. Many consumers don’t want 3rd parties to rummage through the details of what they’ve been spending money on, especially if there are illicit dealings.

People also don’t want to pay with something whose price changes 20% on a given day. That’s why cryptocurrencies like Facebook Libra, who are targetting digital payments, are designing their digital currency to be price stable.

3. Utility Tokens

Utility tokens are cryptocurrencies that are used to pay for services on a given network. Think of it as a cryptocurrency version of loyalty points that you can spend at your favourite store.

Users who want to spend computational resources on the Ethereum blockchain must pay for it using Ethereum.

If the service is valuable, then the utility token will be too. The price of a utility token is a proxy measure of the utility’s current and future demand.

Typically utility tokens are usually uncapped, meaning that they have a potentially infinite supply.

4. Security Tokens

Security tokens are a digital representation of some real-world asset on the blockchain, e.g. equity, real estate, debt, etc.

In theory, the price of the security token should closely resemble what the underlying asset is worth.

But in the real world, you may see a price gap between the security token and its underlying asset. Some may favour the security token if it is more liquid than the real-world asset. In the financial world, we call it a liquidity premium.

If the security token is illiquid, and it is hard to redeem the security token for its real-world counterpart, then the price of the security token can actually, be much lower.

Store of value cryptocurrencies and security tokens are the better investment options available to cryptocurrencies investors.

The former holds value because of its scarcity and inelastic supply. The latter holds value if the asset it represents value.

Utility tokens can often have an unlimited supply. Typically assets with infinite quantities don’t usually make suitable investments.

Digital currencies are meant for day to day use and do not appreciate in value. Therefore, they do not make suitable investments either.

How Are Cryptocurrencies Priced?

How was it possible that cryptocurrency prices have jumped so much in the last ten years? How are prices determined? Are they valued based on an intrinsic valuation model or are prices determined by pure speculation?

While many people are actively trying to create fundamental, bottoms-up valuation models for individual cryptocurrencies, prices are in-large determined by supply & demand.

Supply & Demand Inside of An Exchange

En masse, aggregate supply and demand are derived from various trading markets such as:

- Exchanges

- OTC desks

- Informal markets

Exchanges are the single largest pools of liquidity, with exchanges like Binance clearing up to $200 million in trading volume in a single day. Therefore, they are also the best example to illustrate how market prices are determined.

On every single exchange, every trading pair has an order book. On the order book, are a collection of bids and asks. A bid is a maximum price someone is willing to buy an asset. An ask is the minimum price someone is willing to sell an asset for.

A collection of bids & asks at all different price points form an order book.

Bids in green on the left side and asks in red on the right side, forming what looks like a valley around the market price.

Moving the Market Price

When someone wants to place a buy order, they will start buying the assets that are available at the lowest prices. Then, if there are not enough sellers, they will move up the order book, and incur higher rates.

If the demand is strong enough, it will start moving the market price upwards.

Similarly, when someone, or a group of people, want to sell a particular asset, they will start selling the assets at the highest available price. When there are not enough buyers, they will move down the order book, and sell assets at a lower rate.

So what is the Market Price?

Every trading market will have its market price, where the bid and ask intersects for a given trading pair.

We can call this the local market price

Sites like Coinmarketcap will derive a universal market price by taking a volume-weighted price average across all trading markets.

Price differences between different trading markets are usually quite small because they are smoothened out by arbitrageurs who will buy an asset in an undervalued market and sell it in overvalued one.

Interesting case study: the Kimchi Premium

Sometimes the price discrepancy between various markets can grow quite large when the forces of supply & demand are different across local markets and there are barriers blockading the movement of flow capital from one to another.

In December 2017, Korean exchanges traded at a 40% premium to other exchanges worldwide.

It was extremely tough to arbitrage between Korean exchanges and other international exchanges since Korean exchanges required investors to show proof of Korean residency. Additionally, there were strict limits on how much money residents could move outside of the country.

Many arbitrageurs formed illicit partnerships with Korean locals in an attempt to profit off of the discrepancy.

Where Do You Buy Cryptocurrency?

There are many different places to purchase and sell cryptocurrency. These locations include:

- Fiat-to-crypto currency exchanges

- Cryptocurrency-to-cryptocurrency exchanges

- Over the counter trading desks

- Hobbyist miners

Fiat-to-Cryptocurrency Cryptocurrency Exchanges

Fiat to cryptocurrency exchanges enables users to trade between cryptocurrency and fiat currencies (USD, EURO, etc.).

The industry calls these exchanges cryptocurrency on-ramps because they are the most popular destinations for investors who don’t have cryptocurrency, to buy some.

These exchanges are usually highly regulated because they deal with fiat currencies. As such, they can only service a few locales. Due to these higher restrictions, these exchanges will tend to have fewer cryptocurrencies available to trade.

Examples: Coinbase, Kraken, Bittrex, Bitfinex

Pros:

- Easily accessible & easy to use (mobile apps available)

- Liquid markets

- Can trade between cryptocurrency and fiat currency

Cons:

- High trading fees between fiat/crypto pairs (1–2%)

- Most require a verification process that can take up to a week

- Limits to how much you can buy based on the verification level

- Fewer trading pairs compared to cryptocurrency-to-cryptocurrency exchanges.

Cryptocurrency-to-Cryptocurrency Exchanges

Crypto-to-crypto exchanges don’t have any fiat/cryptocurrency trading pairs. You can only trade from one cryptocurrency to another.

Typically these exchanges are less regulated because they don’t deal with fiat currencies and serve a broader range of international users. They also feature a high number of cryptocurrency trading pairs due to the more lax regulations that surround the exchange.

Examples: Binance, KuCoin

Pros:

- Easily accessible & easy to use (mobile apps available)

- A large number of trading pairs

- Lax verification process

- Low trading fees

Cons:

- Some fringe trading pairs have inferior liquidity

- Cannot trade fiat currency

Over the Counter

OTC trading is done directly between two parties. Typically the OTC desk has a large pool of assets they can use to trade against their clients.

If you’re trying to trade a large number of cryptocurrencies without disrupting the market, OTC desks may be your best bet.

Don’t expect a large amount of variety or choice from OTC exchanges. Most just sell Bitcoin. OTC desks will also probably not sell to you or buy from you if you have insignificant amounts.

Hobbyist Miners

Miners may prefer to sell their cryptocurrencies to directly to buyers instead of depositing it on an exchange. Typically the exchange method incurs a higher degree of transaction fees, especially if they are trying to convert it into fiat.

If you can find a hobbyist miner for your specific coin, you may be able to get it at a pretty substantial discount.

Why Invest in Cryptocurrency

Portfolio Diversification

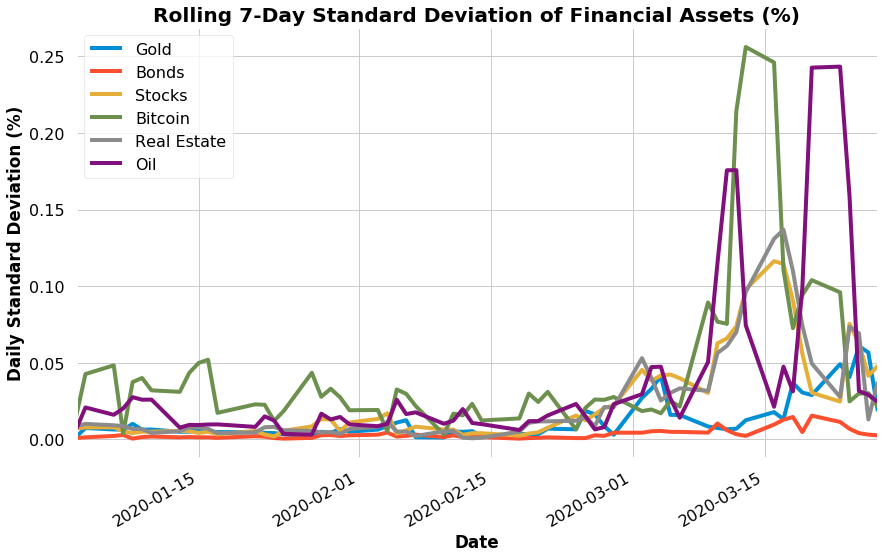

Correlation between Bitcoin and other significant financial assets is low. Adding Bitcoin to your traditional portfolio of equities, real estate, commodities, currency, and bonds, actually may very well reduce the overall risk of your portfolio, while improving returns.

Hedge against the global financial system

While fiat currencies are inflationary, cryptocurrencies like Bitcoin are deflationary.

There will only be 21,000,000 Bitcoin ever. The minting schedule has already been determined and will never change.

In the short-run, the price stability of Bitcoin is properly too volatile to be a good store of value. But in the long run, some may want to bet on Bitcoin as a proper store of value, and as a hedge against the inflationary fiat currencies, they are using.

Privacy

Contemporary financial institutions track almost every cash-less way of spending your money. Your financial information is being sold and resold to the highest bidder. If you care about protecting your data, then using cryptocurrencies can be an excellent remedy. Privacy coins like Monero and ZCash obfuscate the nature of your transactions.

Owning censorship-resistant assets

For those who live in authoritarian and politically corrupt regimes, the government can arbitrarily impose draconian limitations on the extent to which you can freely use and spend your own money. They can freeze your assets at will.

Countries like Venezuela saw their citizens seek refuge in cryptocurrency, as trust and belief in the national assets fell to the wayside.

Having a nest egg tucked away in cryptocurrency means there is at least a portion of assets that are indeed your own, and cannot be appropiated.

Why Not Invest in Cryptocurrency

High-interest debt

“Once my crypto portfolio moons, the first thing I’ll do is pay off my student loans and credit card debt. — Anon Trader #385

If you have credit card debt or any debt with high-interest rates, do not purchase cryptocurrency until you’ve paid it off. The same applies if you’re borrowing money to buy cryptocurrency.

Cryptocurrencies are incredibly volatile. They are not going to dig you out of debt and liberate your life. All cryptocurrencies can take a nose-dive for the next ten years.

If you can’t afford to pay off high-interest debt, then you can’t afford to invest in cryptocurrency, period. Better to miss a potential opportunity, than to fall into financial ruin. Don’t be this guy.

You want to day-trade because you think day-trading cryptocurrency is easier

“I heard I could achieve financial freedom by learning how to daytrade Bitcoin because it’s way easier than Forex. — Anon Trader #1335

Traders are continually seeking new and improved strategies regardless of the asset class. While cryptocurrency may seem like a new asset class to you, it’s been home for a myriad of algorithmic traders & professional traders for years now.

If you’re looking for low-hanging, simple opportunities to trade and make money, you’ll find nothing but slim pickings here. Financial markets are ruthlessly efficient.

You Want to Invest in the Newest Fad Cryptocurrency

“PoW Blockchains Networks are so 2017. I’m all about PoS, DAGs, ternary number systems, zero-fee, scalable blockchains — Anon Trader #532”

New, cutting-edge technology does not a market, win. Cryptocurrencies are trying to disrupt existing human networks. The main two are centralized fiat currency networks and centralized human organizations. As such, it is not so much the technology that dictates the pace of disruption, but rather also the social and economic properties of a cryptocurrency network that will determine whether it is successful.

Bitcoin took existing technology and shaped it into an application that had the right economic incentives and disincentives for the network participants. Bitcoin’s value grew as the network became more extensive, more robust, and more difficult to displace.

It’s not easy for a new cryptocurrency to win by merely having novel technology. All these new fad technologies coming out are about making the blockchain scale faster, operating cheaper, as if that was the sole determining factor on whether a cryptocurrency network will succeed. Not only are these novel applications untested and finicky, but they also don’t have scale.

You have FOMO and Want to Make Money Quick

“I know it’s a bubble. I want to get in and get out before the bubble pops” — Anon rader #1935

It is extremely tough to time the market. While it might go up as it did in 2017, it could also come crashing down like 2018. Most professional traders get it wrong.

If you treat cryptocurrency investing like make money quick scheme, you are essentially gambling.

People who got FOMO and started investing as it was going up in 2017, lost a ton of money that they still haven’t recovered. Greed and FOMO are more dangerous than anything because it will push to gamble more money than you are prepared to lose.

You Don’t have an Emergency Cash Fund

“Every time I pay rent, I just pull it out of my cryptocurrency portfolio” — Anon trader #321

If you don’t have an emergency cash fund, you shouldn’t invest in cryptocurrency. Do not treat cryptocurrencies as an equivalent.

While cryptocurrencies may be “liquid” to trade against other cryptocurrencies, they are not so liquid in real life.

Withdrawing cryptocurrencies and exchanging them for fiat always takes longer than you think. It can be an incredibly arduous process.

You can’t buy many goods & services with cryptocurrency without dealing with a fiat-crypto exchange. Also, you don’t want your liquid assets to be super volatile and change up to 20% in a single day.

Investment Strategies

There are two major schools of thought for investing.

- Passive investing— diversify your portfolio over the entire market, index, and rebalance, to reliably capture the average market return

- Active investing — speculate, try to pick the winners, time the market, in an attempt to beat the average market return.

Passive Investing

Passive investing is anchored in a belief, or at least an appreciation, of the efficient market theory.

The efficient market theory states that assets all information in a market is already priced in and that consistent market outperformance is impossible.

While this may be a bit of an over-exaggeration, there is a lot of evidence out there to support this theory.

According to the 2018 SPIVA U.S. Scorecard, 80% or more of active managers across all categories underperformed their respective indices.

While short-term results were more comparable, active managers were not able to keep up over the long-run.

In 2019, Morningstar made a similar comparison and found out that only 23% of active fund managers were able to outperform the market average.

The stock market is not the same as the cryptocurrency market. But I wager that in the cryptocurrency market, it may be even more difficult to beat index funds. Consider the fact that the cryptocurrency market is rampant with market manipulators, insider traders, and pump & dumpers, all looking to rip off the little guy.

What does this mean for cryptocurrency investors?

Unless you are trading cryptocurrencies professionally, it’s highly likely that you will underperform a low-cost index fund (e.g. a fund comprised of the top 30 coins weighted by market cap).

Market Indices & Portfolio Diversification

Part of the reason why market indices kick ass is that they offer ample portfolio diversification.

Diversification is good because it can reduce risk. By including assets with low or negative correlations in your portfolio, you can reduce the overall variance even if the individual assets are volatile.

By lowering risk, you can increase your risk-adjusted return.

Diversification is more important than ever as correlations between cryptocurrencies weakened in 2019.

How to Passively Invest

- Select an index fund or DIY on your own portfolio

To identify a good cryptocurrency index fund, you should find one that is:

- Tracking the total cryptocurrency market cap very closely

- Liquid enough so that investors can redeem the value of the underlying assets are market price quickly

- Accessible to non-accredited, everyday investors

Here’s why these things matter:

- Tracking the total cryptocurrency market cap very closely

A cryptocurrency index’s primary objective is to track the global cryptocurrency market.

The ideal index consists of every single coin in the market, weighted by market cap. Unfortunately, creating such a portfolio is infeasible because of minimum trading amounts and trading fees. The only option left is to take a sample.

In principle, the larger the sample, the more accurate it will be in tracking the overall market. But as the sample grows bigger, the more difficult and costly it is to maintain. Most cryptocurrency indices have much too few coins in their index because they opt for the ease of managing a portfolio with fewer assets. E.g. Coinbase index

Another problematic aspect is the weighting strategy. Most indices simply take the top N coins by market capitalization. But if we simply weighted the top 20 coins by market cap, we would end up with an extremely top-heavy portfolio. The index wouldn’t do a great job at capturing the risk & performance of the lower-capped coins.

So what are ways to give more exposure to lower capped coins?

Include more coins in the index

At HodlBot, you have the choice of indexing as many coins as you wish. You can index the top 100 coins by market cap if you want to. The only trade-off to consider is transaction fees and exposure to lower-capped coins, which typically can be more volatile.

Using a maximum percentage cap

For the HODL20 index we created, we capped every coin to be at most 10% of the total portfolio value. Anything above 10% gets redistributed to all the coins below 10% until the entire sum of the portfolio adds up to 100%.

Using square root weighting

For the HODL30 index, we used square root market cap weighting. The weighting shifts some of the portfolio value from the highest capped coins towards the lower-capped coins. However, it still keeps a difference in weighting between differently ranked coins.

2. Liquidity of the index fund shares

In theory, the market price of a single share in a cryptocurrency index fund should be equal to the market price of the underlying assets it represents. But more often than not, this is not the case.

Whenever there is a price discrepancy, the fund relies on market arbitrageurs to resolve the difference. For example, if the shares are worth less than the underlying assets, arbitrageurs can buy up the shares, redeem them for the underlying assets, and make a profit.

But huge price discrepancies can exist and be very large when the market does not have a lot of buyers & sellers, transaction fees are high, and it’s hard to get money in & out.

Investors beware because these containers can amplify volatility on top of the already existing volatility. When making a withdrawal, you can get stuck at making one below market price.

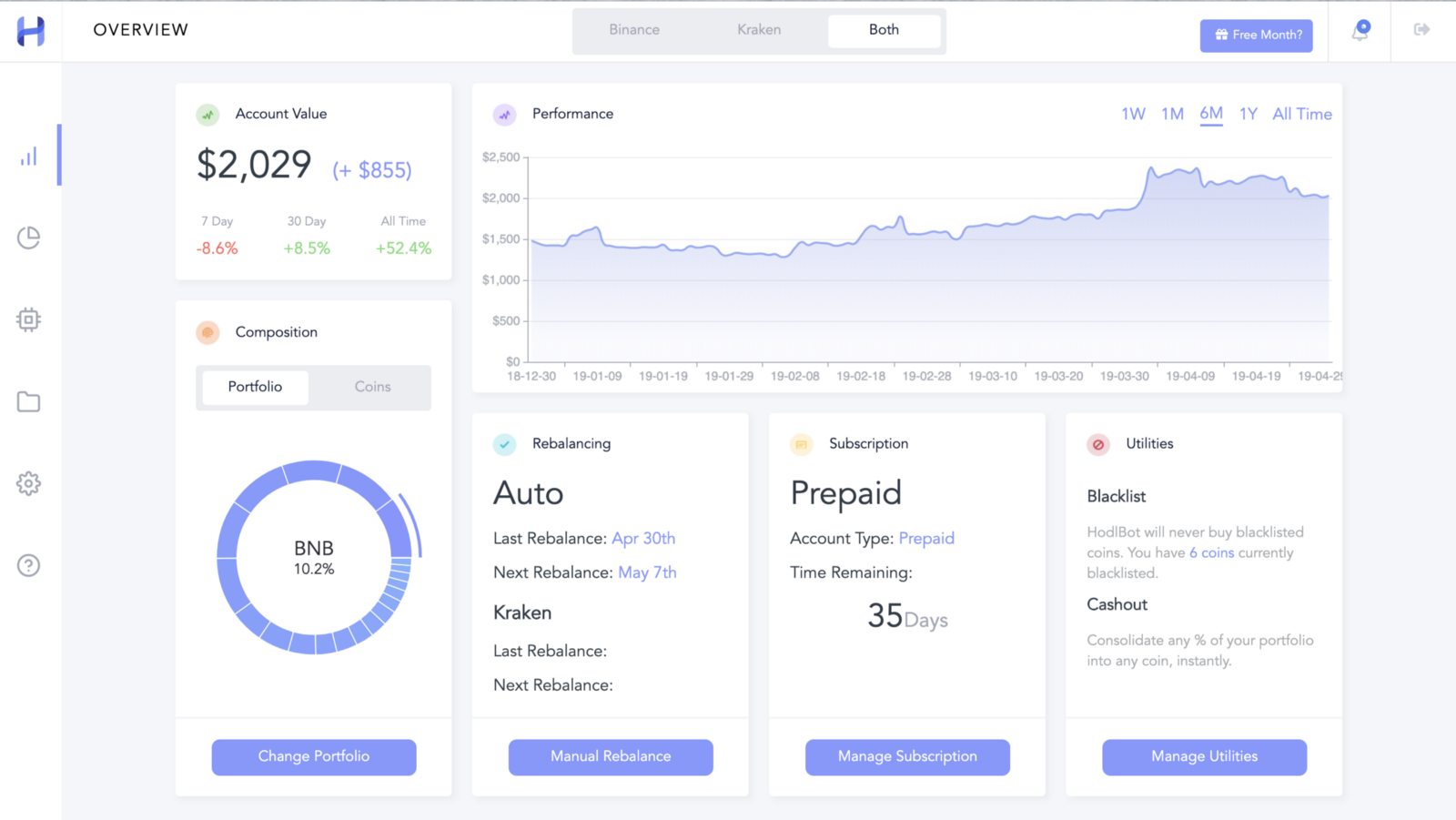

At HodlBot, we take a different approach. Users hold onto the underlying assets themselves. HodlBot executes whatever trades are required to maintain a weighting that mimics an index. There is never a price discrepancy between the index and its market price. Users can get out of the market any time they want by selling the underlying assets at market price.

3. Accessibility to non-accredited investors

Almost all cryptocurrency index funds are only eligible for accredited investors (net worth >$ 1 million). They are also likely to be landlocked to a specific jurisdiction and unavailable in others (e.g. exclusively available in the US). The Coinbase Index fund, The Cryptos Fund, Bitwise are all limited by these restrictions.

Again, we designed HodlBot to avoid these problems. Because HodlBot is a software tool and not a fund, it’s available to non-accredited investors living anywhere in the world.

We wrote on a guide reviewing every single major cryptocurrency index fund here.

2. Schedule periodic rebalances

When asset prices change, the market capitalization of coins will change as well. When market cap changes, the index will demand a different % allocation.

Therefore, we’ll need to sell the assets that are over-weighted, and purchase the coins that are under-represented. We call this portfolio rebalancing.

Let’s take the HODL20, which is an index comprised of the top 20 coins by market cap. If a coin drops out of the top 20, then it will no longer be included in the index. The subsequent rebalance will sell the coin that is no longer in the top 20, and replace it with a new one.

Look at how much the top 20 coins by market cap have changed over a 5-year period. How many coins in 2015’s top 20, do you still want to hold?

3. Dollar-cost average into your investments

Portfolio diversification can reduce unsystematic risk, but it leaves another area of risk untouched — market timing risk.

Most investors and professional money managers fail to time the market well. Multiple research papers conclude that money managers tend to underperform the market, such this one from the journal of portfolio management.

As the old adage goes: “time in the market beats timing the market”.

Dollar-cost averaging is a passive investing strategy to mitigate timing risk. Simply divide up the total amount you wish to invest across periodic over time (e.g. once per week). There is evidence to suggest that DCA can lower your average cost of buying in.

However, Bernstein warns that investors should not DCA for longer than 12 months since the opportunity cost of not being invested in the market will offset any gains from risk mitigation over a long enough period.

Active Trading

If you want to prove the efficient market theory wrong, and beat the market, then active trading strategies are what you need.

We wrote a more extended guide about day trading here. It contains all the basic information you ought to know before you start.

Technical Analysis (Trend Analysis)

Technical analysis is bread & butter for most day traders. These kinds of traders use indicators and charts to help them make predictions about how the market is going to change. It is quite a difficult thing to do for both humans and trading bots alike and take a lot of practice to get right.

Here are some of the most popular technical trading indicators:

Moving Average Convergence Divergence (MACD)

The MACD indicator is calculated by subtracting the 26-day exponential moving average from the 12-day.

When you plot the MACD, you get a chart like this.

The important thing here is to note when the MACD and average lines cross. If the MACD line crosses up through the average line then it is considered a “bullish crossover”, which is a standard recommendation to buy. If it crosses down, then it is regarded as a “bearish” crossover, and the advice is to sell.

The crossovers are indicators that the price is about to accelerate in the direction of the crossover.

Bollinger Bands

Bollinger bands are a set of lines plotted two standard deviations away from a simple moving average.

When the bands close together, it is called a squeeze. A squeeze signals a period of lower volatility. A break out happens when the price moves past the range of the Bollinger band. Some view this as a trading signal, others as a simple sign of increased volatility.

News/Sentiment Trading

When significant news breaks, it will often affect the price. Some traders use news breakouts as an opportunity to predict the market.

Example of news outbreak that has been linked to price movements:

News trading works better during a bull market when market participants are more sensitive and paying attention.

It is also important to note that the market may already have predicted the news and priced it in. Therefore a news breakout can often have a null effect or even an opposite one.

Market Making

Market making is a strategy where the trader simultaneously places both buy and sell orders in an attempt to profit from the spread between the highest bid and the lowest ask, otherwise known as the bid-ask spread.

Market makers stand ready to both buy and sell from other traders, thus providing liquidity to the market.

Example:

If let’s say, BTC is trading at $17,000 a pop. You create a buy order for $16,999 and a sell order for $17,001. When both orders get filled you earn $2, the spread, for providing liquidity to other traders.

Arbitrage

When you buy an asset in one market and simultaneously sell it in another market at a higher price, that’s called arbitrage.

There are two different ways to arbitrage cryptocurrencies. The first is by finding prices mismatches through different trading pairs on a single exchange. The other is by locating price differences across multiple exchanges.

Inter-exchange arbitrage opportunities are more readily available because there is additional complexity associated with having to withdraw assets from an exchange.

During the legendary kimchi premium, Bitcoin traded close to 40% higher on Korean exchanges compared to US exchanges. Arbitrageurs made a profit by buying Bitcoin on US exchanges and selling it on exchanges where BTC was trading higher.

Investment Tools

As a contemporary trader, you don’t need to do everything by hand. One of the best things about the cryptocurrency space is how quickly user-friendly financial tools & applications have leapfrogged and surpassed traditional finance.

There 4 major categories of useful tools:

- Portfolio trackers

- Portfolio management bots

- Active trading bots

- Tax tools

Portfolio Trackers

Keep track of what’s in your portfolio across exchanges and wallets. They track your financial performance over time and can give you information about profit/loss on trades that you’ve made.

You can also set up price alerts in these applications.

Examples: Delta, Blockfolio, Cryptocompare Portfolio

Portfolio Management Bots

Portfolio automation bots help users create, obtain, and maintain their desired portfolio. These bots are not necessarily trying to beat the market, but instead just helping users automate as much of the boring stuff as possible like portfolio rebalancing. This is my favourite category of tools.

Just as a disclaimer, HodlBot is an example of such a tool. We help investors pick from pre-constructed indices, or create their custom portfolio. Then we automatically rebalance their portfolios to keep it on track.

Active trading bots

Technical trading bots trade on indicators & signals. They try to predict future price movements and use these predictions to make a profit. These are by far the most popular and most widely used bots on the market.

Disclaimer: many of these bots will profit you absurd profits that are unrealistic. In reality, you need to put a lot of time developing and testing automated strategies to see if they work. Unfortunately, even equipped with trading bots, most traders will fail to beat the market average.

e.g. ProfitTrailer, Cryptohopper, etc.

Tax Tools

When it’s time to face the taxman, you’ll be happy that these tools exist. To use these tools, simply export your transaction history from the exchanges you’ve been trading and upload it into these applications. You can also connect your API keys. These applications will generate tax-friendly reports for you specific to your jurisdiction.

e.g. Cointracking.info, Cointracker

Where Do I Store my Cryptocurrency

When it comes to storing your cryptocurrency, there is a trade-off between security and convenience.

On-Exchange

Storing your cryptocurrency on exchange essentially means that you are trusting the exchange to custody your assets for you.

If they are a trusted and reputable exchange like Binance, then it is not the end of the world. But you should be cautious not to trust small, unknown, fringe exchanges without a reputation.

The reason why you would keep your assets on an exchange is so that you can quickly execute trades without having first to send your assets to the exchange. A deposit incurs blockchain TX fees, and can also take hours to execute.

Hardware Wallets

Hardware wallets are the most secure way to store your crypto,but it is the least convenient way.

Ledgers are the absolute market leader hardware wallets. They support more than 1250+ different cryptocurrencies.

Once offline, someone can’t gain access to your cryptocurrency wallets without your private key.

Software Wallets

Software wallets are non-physical programs that you can download on your phone or computer. A password encrypts the wallet. Software wallets are less secure than hardware wallets because they are still connected to the internet and can be attacked by hackers who figure out your recovery phrase or password.

How Do I Deal with Taxes?

Concerning taxation, most countries consider cryptocurrencies as a commodity or a piece of property. As such, cryptocurrency taxes fall under the rules concerning capital gains and losses.

Capital Gains

A capital gain is a rise in the value of an asset above the original purchase price. Generally speaking, you are not required to pay capital gain taxes until the asset is sold, gifted, or traded.

Holding an appreciating asset means that you are accruing capital gains on paper. But as long as you never relinquish the asset, you are not required to pay tax.

Capital Losses

If the value of an asset falls below the original purchase, then you are accruing capital losses. Capital losses don’t come into effect until the asset is sold, gifted or traded.

Generally speaking, you can use capital losses to reduce the amount of taxes you have to pay in a given year. The U.S. caps capital loss reduction to $3,000 annually, but you can apply the excess for future years indefinitely.

Actions that trigger taxable events:

- Selling cryptocurrency for fiat currency (i.e. USD, CAD, EUR, JPY, etc.)

- Trading cryptocurrency for another cryptocurrency

- Using cryptocurrency to buy a good or service

- Mining cryptocurrency (above $300)

- Gifting cryptocurrencies to another party (if above some threshold amount).

Actions that don’t trigger taxable events:

- Holding the cryptocurrency

- Buying cryptocurrency with fiat currency (except in cases where the purchase price is lower than the fair market value of the purchased coin)

- Donating cryptocurrency to a tax-exempt organization

- Gifting cryptocurrency to anyone (if the gift is sufficiently large it may trigger a gift tax)

- Transferring cryptocurrency from one wallet that you own to another wallet that you own

How Capital Gains/Losses are Calculated:

Acquisition Cost:

The acquisition cost is the price you paid to obtain the asset. The cost includes transaction fees and commissions related to the sale.

Amount Realized:

The amount realized is the price you are redeeming, trading, or redeeming your cryptocurrencies for.

Examples:

- Trade 1 coin for a service valued at $10 — $10 is the amount realized

- Trade 1 coin for 2 coins valued at $5 each — $10 is the amount realized

- Trade 1 coin for $10 — $10 is the amount realized.

Capital Gains vs. Losses:

Subtract the acquisition cost from the amount realized. A positive number signifies capital gains and a negative number, capital losses.

Long-term vs. Short-term Capital Gains:

Depending on how long you hold the cryptocurrency, either short-term or long-term capital gains tax rates will apply.

Generally, periods of one year or shorter are considered short-term capital gain or loss. Taxation laws typically file periods of one year or longer under long-term capital gains or losses.

Generally speaking, long-term capital gains tax rates are lower than short-term.

First In, First Out:

Governments typically treat assets that are fungible on a first-in, first-out basis. What does this mean?

Year 1 you buy 10 coins

Year 2 you buy 10 coins

Year 3 you sell 10 coins.

The 10 coins you sell in year 3, are presumed to be from the first purchase in year 1 because it was the first in.

I don’t want to have to do this manually, what are the best tools?

Chances are that if you’ve invested in cryptocurrency, you probably are pretty tech-savvy and prefer to use software to automate the boring stuff.

Here are the best tools:

- Cointracking.info (Europe, Australia, Canada)

- Cointracker.io (US)

How do these tools work?

- Connect data sources (exchanges, software wallets, etc.)

- Upload manual data & make adjustments (trade history, adjustments)

- Select country

- Export tax report