Bitcoin Prices

I don’t usually follow day-to-day Bitcoin price movements, but we haven’t seen a day like this in a long time.

Bitcoin’s price shot from ~$4,100 to ~$5,000 (+22%) in the span of 48 hours.

Times like these are interesting. Enhanced trading volumes and demand create unique market phenomena. One specific phenomenon is price discrepancy across cryptocurrency exchanges.

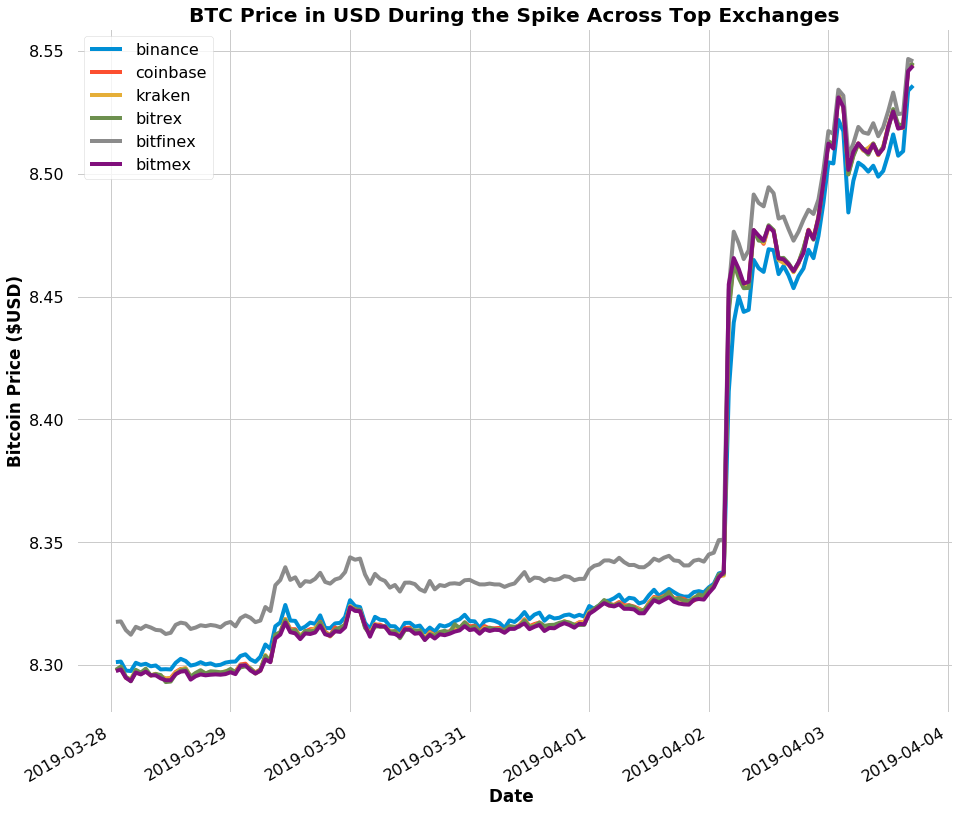

If we look at prices on an hourly time-scale, you’ll see that there is a clear price discrepancy across the top cryptocurrency exchanges. This is typical during a big run or sell-off.

In this particular case, Bitcoin prices on Binance are lagging behind other major exchanges.

Binance, Bitrex, Bitfinex, Bitmex, Kraken, and Coinbase prices are considered

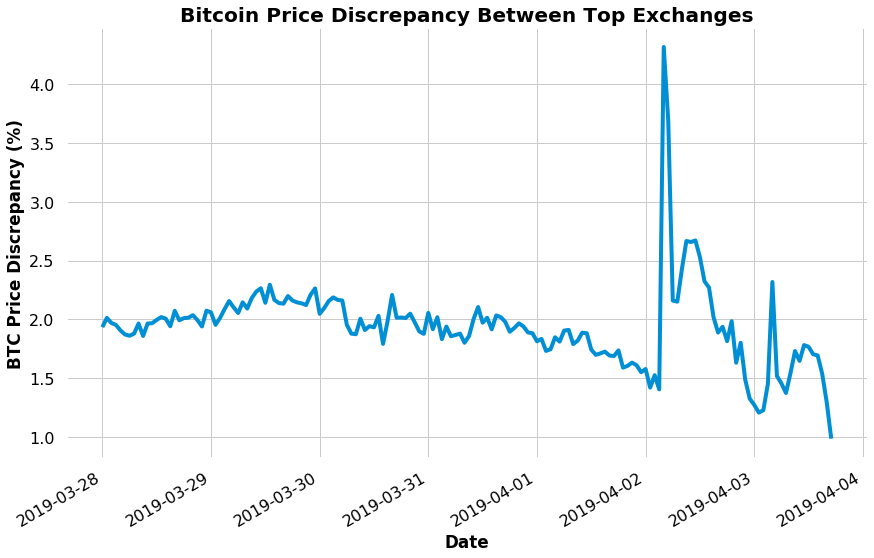

If we plot, the price discrepancy range as a % of the average Bitcoin price, we’ll see that the discrepancy between exchanges goes up to ~4.3% during the peak.

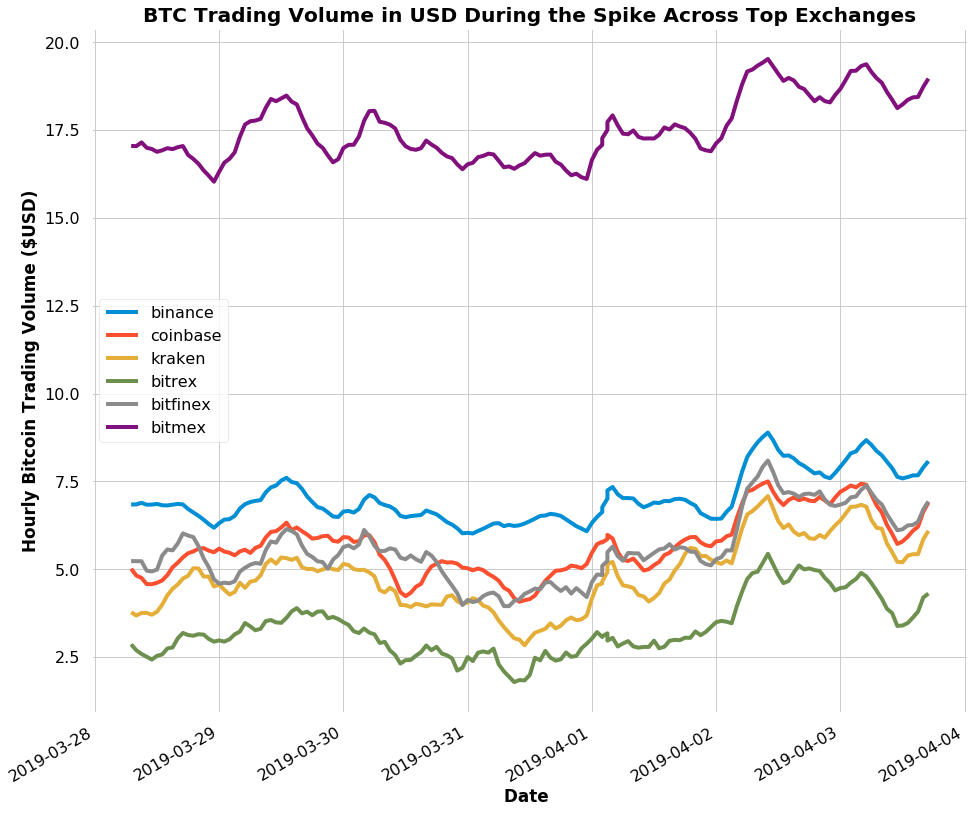

Bitcoin Trading Volume

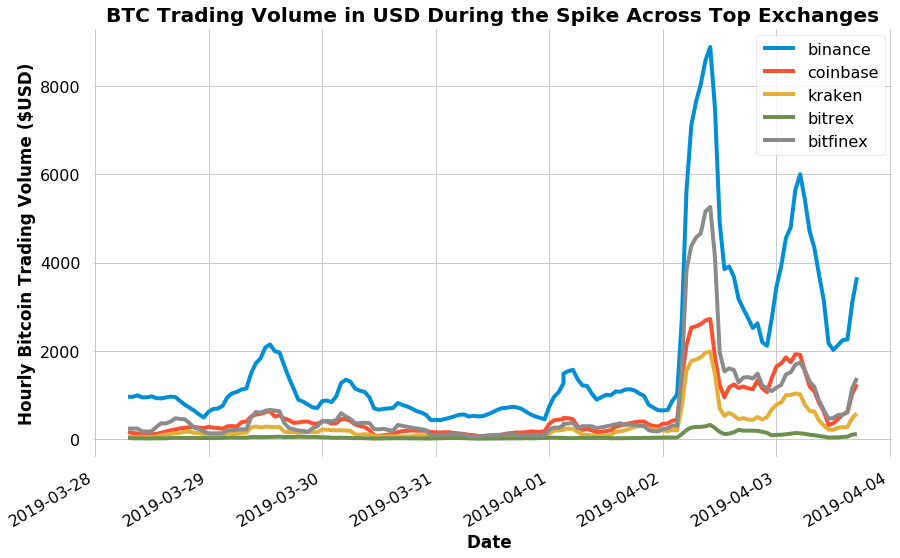

As you would expect, trading volume for BTC has also exploded. On top exchanges, BTC/USD and BTC/USDT dominate the top trading pairs.

Without Bitmex plotted, Binance leads the pack for trading volume.

Volume smoothed using 7-hour moving average

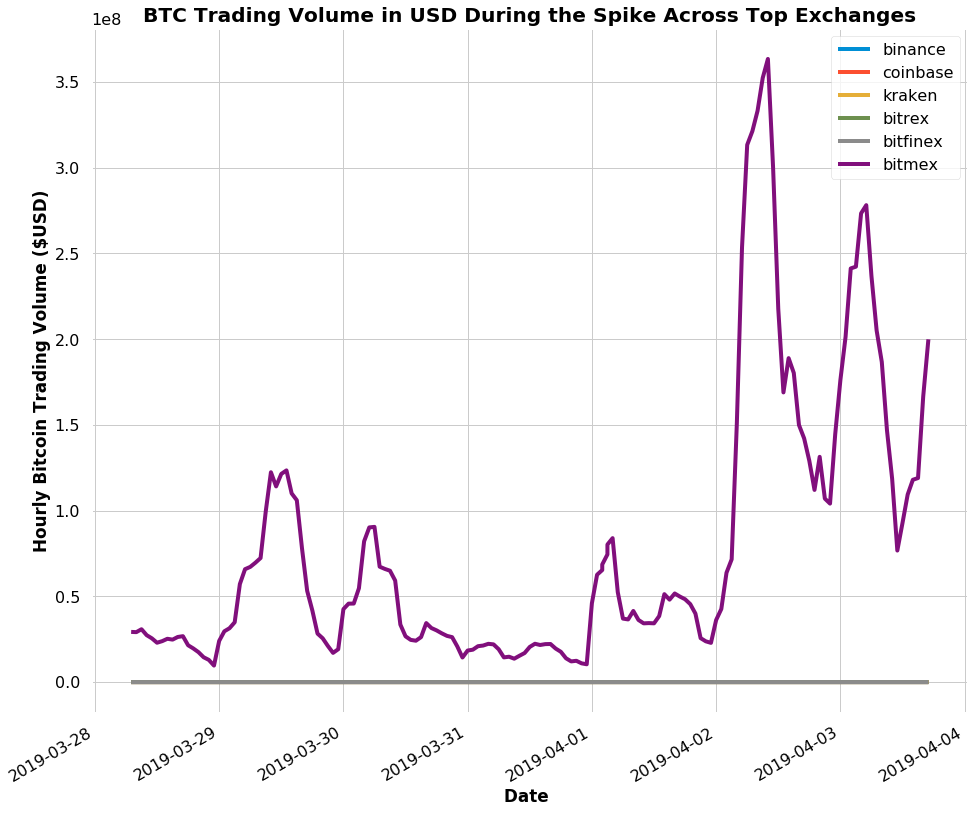

But once Bitmex is in the picture, it absolutely eclipses all other exchanges.

Volume smoothed using 7-hour moving average

We have to plot this puppy on a log scale to view it in relation to trading volume on other exchanges.

Volume smoothed using 7-hour moving average

The spike doesn’t look as huge on a log scale, but that’s deceiving. Bitmex’s hourly volume shot up close to 10x. Bitmex reported ~$9 billion in trading volume across BTC/USD in the last 48H.

What a day!