Stock indices are an age-old construct in traditional equity markets. They are designed to track the performance of the stock market as closely as possible. Ideally, any change in the overall market represents an exactly proportional change in the index.

Indices, naturally, have been ported over to cryptocurrency. And here in the land of blockchain, they serve two purposes.

- Indices gauge how the total cryptocurrency market is performing.

- Firms use indices to create index funds. Passive investing has become very popular. Over the last 15-year period, 95% of active funds failed to beat index funds. Cryptocurrency index funds make it possible to get exposure to the entire market, in a low-cost way.

What is a Cryptocurrency Index?

Simply put, cryptocurrency index funds are portfolios designed to track the performance of the cryptocurrency market.

By definition all index funds are:

- Investable

- Completely transparent

- Systematic & rule-based (no personal judgement)

But just because an index fund follows these rules does not mean they are all the same. Their biggest difference between them is decidedly based on what segment of the market the index wants to track. There are 3 major index categories which we will cover in detail:

- Total market — tracks the performance of the entire market

- Size-classified — segments based on size (low cap, medium cap, etc.)

- Category-classified —segments based on coin category (privacy coins, utility coins, store of value coins, etc.)

Total Market Index Fund

Total market index funds try to track the performance of the entire market.

Stock Market Example:

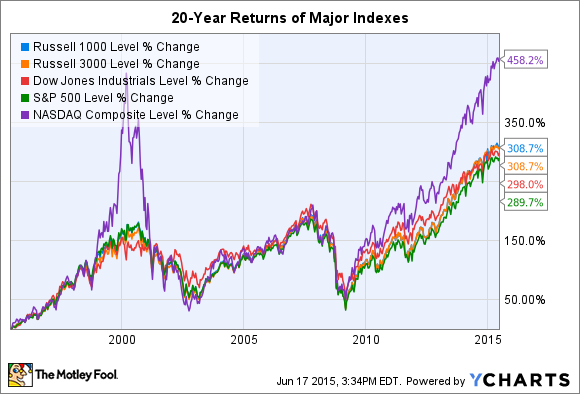

In the stock market, the S&P500 and Russell 3000 examples of indices that approximate the performance of the entire US stock market. If the S&P500 and Russell 3000 are down, then the overall stock market is very likely to be down as well. Vice versa.

Cryptocurrency Market:

When it comes to cryptocurrency indices, the idea is very similar. Total market indices attempt to track the performance of the entire cryptocurrency market.

The ideal total market index is a portfolio that contains every single coin weighted by market cap. But because this is impossible, we have to take a sample.

A larger sample tracks the market better. But larger samples are more costly to maintain.

As we will see most indices, in practice, will simply take the top 20 or top 30 coins by market cap, as an approximation of the entire market.

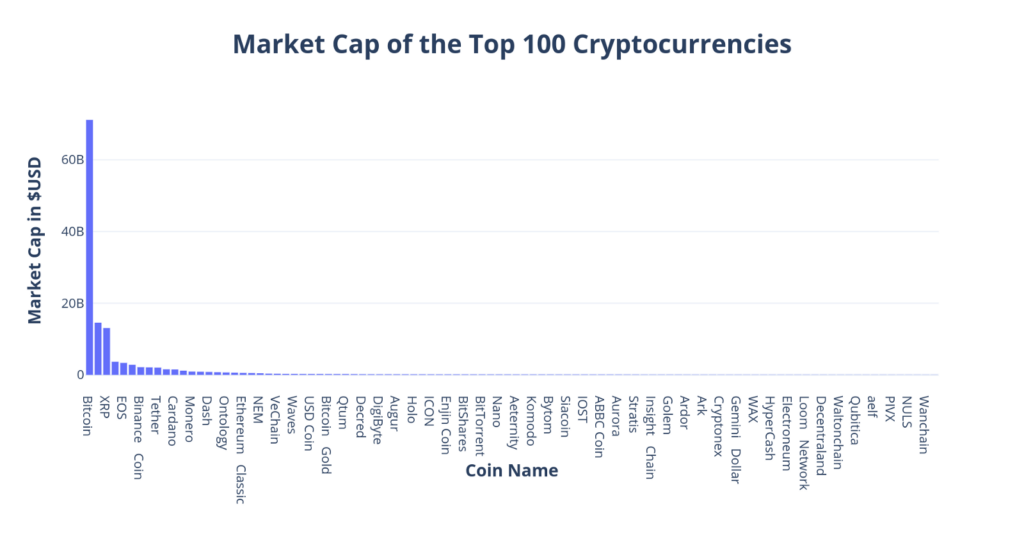

This works because the cryptocurrency market is so top heavy. The top 30 coins by market cap comprise ~90%+ of the entire market cap.

Size-Classified Index Funds

Rather than trying to capture the performance of the entire market, some index funds try to capture the performance of a smaller segment.

Stock Market Example:

In equity markets, the S&P600 includes 600 small-cap companies that have a market capitalization between $450 million and $2.1 billion. The S&P600 approximates the performance of small-cap companies in the US stock market.

Cryptocurrency Market:

The cryptocurrency equivalent are index funds that exclusively track the performance of small-cap or medium-cap coins.

On HodlBot you can create such an index by selecting a starting rank, and ending rank. Here a few examples:

- Coins ranked 20–50 (medium cap)

- Coins ranked 50–100 (small cap)

- Coins ranked 100–500 (tiny cap)

Interface for creating your own personal index fund. 2 minute set-up

In the equities market, many investors presume that small-cap stocks grow much faster than their large-cap counterparts and that any additional risk can be sufficiently mitigated with broad diversification. In the cryptocurrency market, many convince themselves of the same conclusion and prefer to diversify across low-cap coins.

But in my opinion, small-cap cryptocurrencies are much riskier than the riskiest small cap equities. ROI on emerging technology companies typically follows a power law distribution, meaning that a few survive and the rest die.

Industry-Classified Index Funds

Since the entire market can be so vast, some indices try to only capture the performance of a single industry vertical.

Stock Market Example:

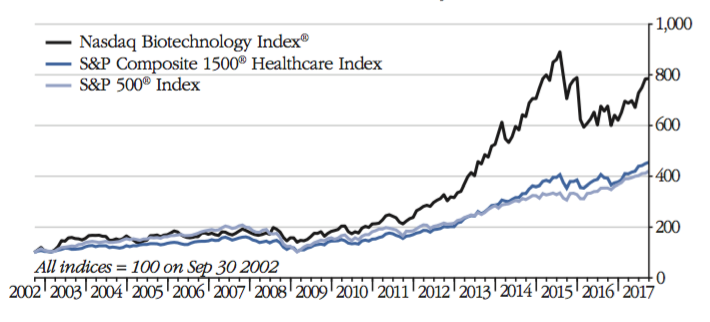

For example, the NASDAQ biotechnology index is comprised of all NASDAQ listed biotechnology or pharmaceutical companies with a $200M+ market cap.

Indices exist for many other industry segments such as metals & mining, oil & petroleum, technology, renewable energy, etc.

Cryptocurrency Market:

In cryptocurrency markets, industry segments are not as well-defined. There is a lot of functionality overlap between different cryptocurrencies so it is a lot more unclear on how to distinctly draw the line between different segments.

Nevertheless, there have been attempts to create indices for different “industry” verticals. The privacy coin index created by altdex is one example.

We’ll likely see more of these as the cryptocurrency market matures.

What Makes a Good Cryptocurrency Index Fund?

In my opinion, the best cryptocurrency index should:

- Track the market it aims to track very closely.

- Be liquid enough so that investors can redeem the value of the underlying assets are market price quickly.

- Be accessible to non-accredited, everyday investors.

The second and third criteria require a qualitative understanding of how the index is constructed.

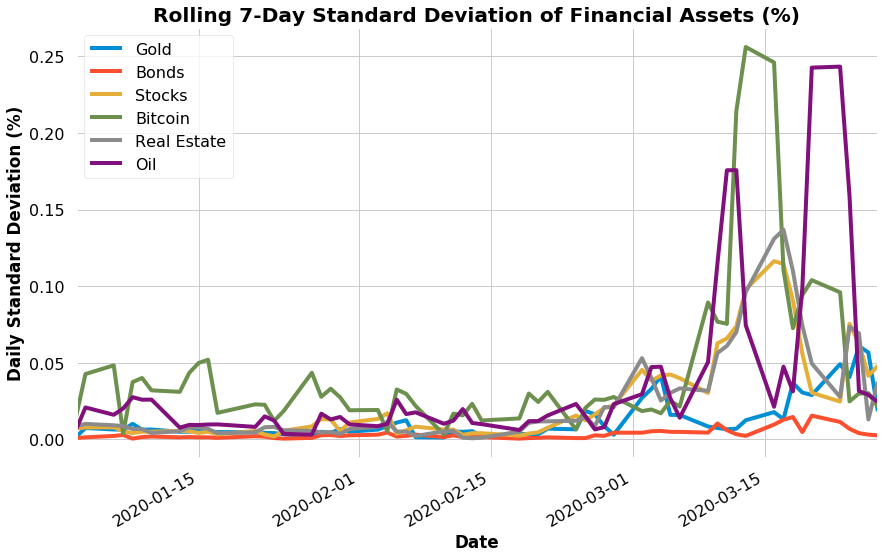

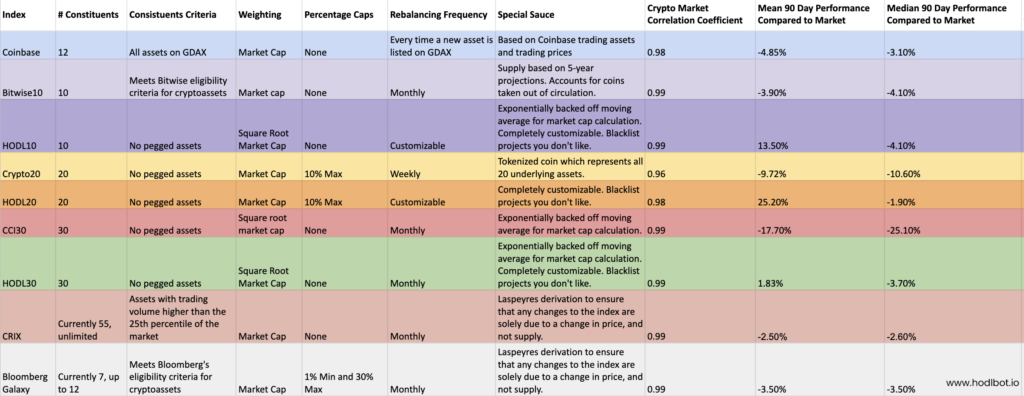

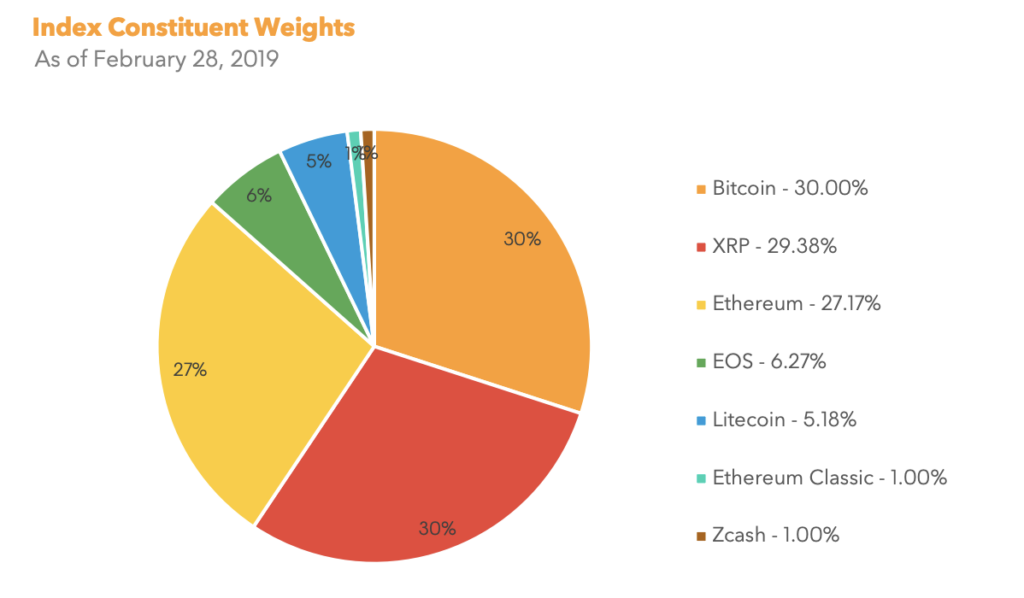

But, we can evaluate the first criteria mathematically by:

Calculating the Pearson correlation coefficient between each index and the movement of market the index is attempting to track.

A correlation coefficient of +1 implies that the pair will always move in the same direction. Conversely, a correlation coefficient of -1 implies that the pair will always move in the opposite direction. If the correlation coefficient is 0, this suggests there is no observable linear relationship between the two.

Analyzing the statistical error between each index and the underlying market.

Even indices correlations close to +1 can end up having disparate returns compared to the market because errors are compounded and grow larger over time.

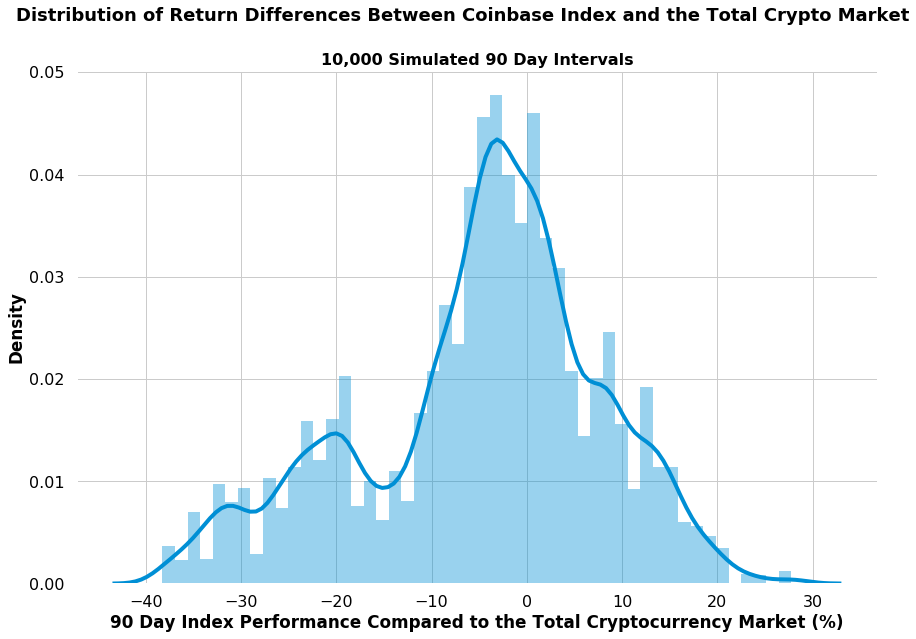

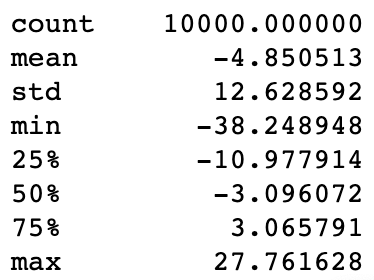

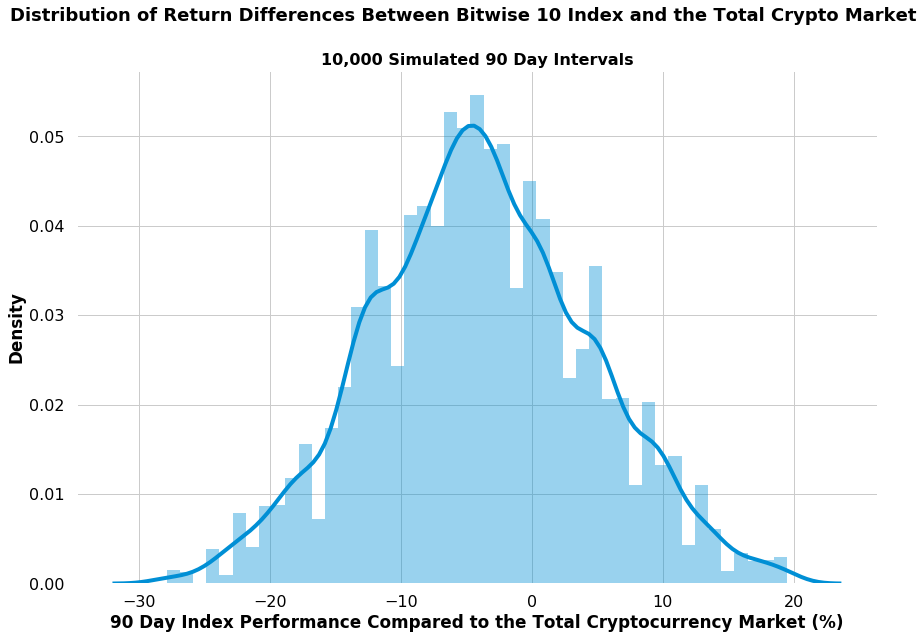

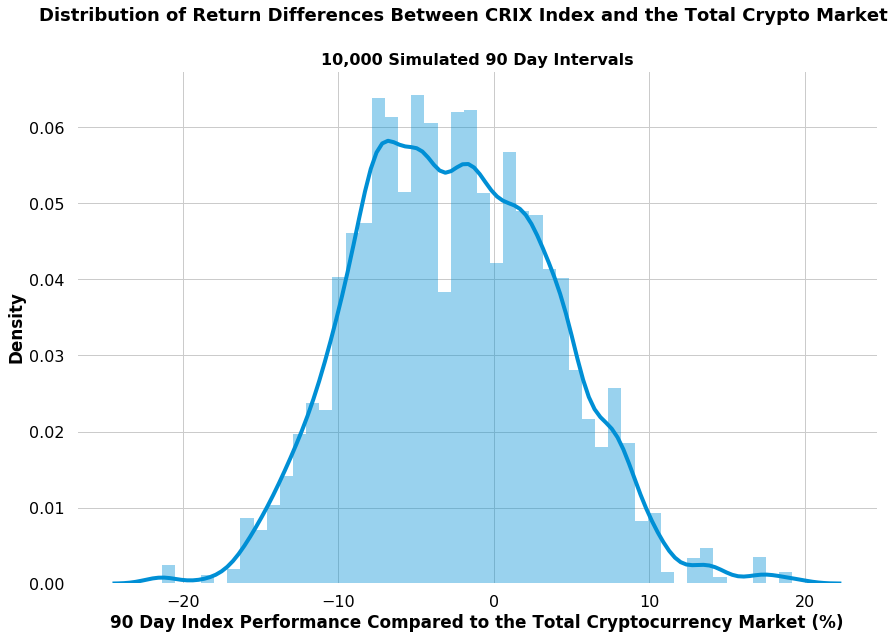

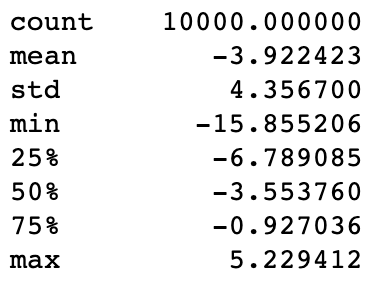

That’s why we’re also going to need a different metric, one that evaluates how well the index performs in relation to the total market. We’re going to derive this metric computationally by taking 1,000 random snippets of time series data that span 90 days each. For each time window, we’re going to compute how many percentage points the index underperforms, or outperforms, the underlying market by.

Indices We’re Going to Review & Analyze

Through a critical lens, we will explore how different well-known cryptocurrency indices are constructed, and evaluate how well they track the market. These indices are all total market index funds, since these are the most well-known and the most popular. These indices include:

- The Coinbase Index

- Bitwise10

- HODL10

- Crypto20

- HODL20

- CCI30

- HODL30

- CRIX

- The Bloomberg Galaxy Crypto Index

TLDR: a summary of findings are presented here for readers who do not want to go in-depth.

Review of Cryptocurrency Indices

1. Coinbase Index Fund

The Coinbase index fund is only available to accredited investors who live in the US. In an effort to make matters simple for investors, Coinbase takes custody of the underlying assets.

Indexing Methodology

The Coinbase index fund includes every coin on its native exchange, GDAX, and weighs them by market capitalization. Keep in mind that these 12 coins are by no means the top 12 by market cap, but simply what it is listed on GDAX.

Rebalancing Frequency

Coinbase does not follow a standard rebalancing period. Instead, the Coinbase index is rebalanced every single time a new asset is listed or de-listed from the exchange.

Special Considerations:

- Coinbase calculates market capitalization based on a fixed supply figure it sets on 5 PM PST Jan, 1, on the calendar year the asset was added to GDAX. Supply adjustments are made every year by multiplying the previous year’s supply with the percentage by which the supply increased after one year.

- The price for each constituent asset is the last trade price on the GDAX USD order book.

Pearson’s Correlation Coefficient: 0.98

There are 2 major reasons that cause the index to differ from total market movement.

- The index uses GDAX prices. There are bound to be inaccuracies when comparing GDAX prices to Coinmarketcap prices.

- The index only consists of 12 coins, and not even the top 12 coins by market cap. The index is missing many large-capped coins that are not listed on GDAX. In addition, the index also does not do a good job of capturing the performance of lower-capped coins especially during “Altcoin” season.

Historical Performance Compared to the Total Cryptocurrency Market

2. Bitwise10

Bitwise has a series of index funds that it offers to accredited US investors. The (Bitwise10)[https://www.bitwiseinvestments.com/indexes/Bitwise-10] is the company’s flagship index fund. It aims to capture the performance of large-cap cryptocurrencies.

Indexing methodology

The Bitwise10 weighs the top 10 coins by market cap. However, Bitwise removes coins that fail to meet their eligibility criteria. Stablecoins are omitted from the indices. Projects like Binance Coin, Cardano, and TRON are also removed. You can read more about the eligibility criteria here.

Rebalancing Frequency

The Bitwise10 is rebalanced once every month.

Special Considerations

Bitwise indices adjusts for free float. For a given cryptocurrency, Bitwise makes a prediction of the number of coins that will never enter the tradeable market and leaves it out of the supply.

Bitwise also adjusts for supply inflation, by calculating market cap based on a a projected 5-year coin supply.

Bitwise’s other indices, Bitwise 20, Bitwise 70, Bitwise 100, are constructed in a similar manner. Coins in the index abide by the same eligibility requirements and their supplies are also adjusted for free float and inflation.

Pearson’s Correlation Coefficient:0.99

3. HODL10 Index

The HODL10 is an index offered by HodlBot. Rather than investing in a fund, HodlBot trades the assets in your Binance account to match the composition of the index.

Indexing methodology

The HODL10 weighs the top 10 coins by square root market cap.

Rebalancing Frequency

The default rebalancing period is 28 days. But you can customize it to whatever.

Special Considerations

The market cap is not computed as an instantaneous number. Instead, the HODL10 uses an exponentially weighted moving average of market capitalization in an attempt to escape some of the day-to-day volatility in the market. This way, the constituents do not change as often.

Pearson’s Correlation Coefficient:0.99

4. Crypto20

Crypto20 (C20) is a tokenized cryptocurrency index fund. Each token represents a small basket of the underlying coins and is theoretically redeemable for their value.

Indexing methodology

C20 weighs the top 20 coins by market capitalization but caps each individual holding to 10%. Anything above 10% gets redistributed to all the coins below by weighted market capitalization until the entire sum of the portfolio adds up to 100%.

Rebalancing Frequency

Rebalances are made every week.

Special Considerations

In order to calculate market cap, C20 uses the current coin supply and multiplies it by their own volume-weighted trading price. The price is volume-weighted based on which exchanges C20 purchases their underlying assets from. Typically, C20 will purchase their coins from exchanges like Kraken, Huobi, Poloniex, Bitfinex, and Binance.

Pearson’s Correlation Coefficient:0.96

The C20 token has a lower correlation coefficient than most other indices.

This is because the price of the C20 token does not always reflect the net asset value (NAV) of its underlying assets. On its most exuberant day, C20 traded 45.6% above the fund’s NAV. A few months later, C20 traded at a -4.3% discount to NAV.

When NAV goes below the C20 token, C20 give token holders a way to liquidate their token at NAV price and get ETH in return. C20 relies on market arbitrage to keep the C20 token from never going below NAV. But this does not always happen due to market illiquidity.

5. HODL20 Index

The HODL20 is another index offered by HodlBot. Rather than investing in a fund, HodlBot trades the assets in your Binance account to match the composition of the index. It is available to non-accredited investors who live anywhere in the world.

Indexing methodology

The HODL20’s indexing methodology is very similar to C20. The HODL20 weighs the top 20 coins by market capitalization but caps each individual holding to 10%. Anything above 10% gets redistributed to all the coins below by weighted market capitalization until the entire sum of the portfolio adds up to 100%.

Rebalancing Frequency

Unlike C20 which rebalances weekly, the HODL20 by default rebalances every month. But you can also customize rebalancing period to be whatever you’d like.

Special Considerations

Also unlike C20, the HODL20 is not a token. Anyone with a Binance account can instantly trade into the HODL20 for free.

The benefit of holding the underlying assets directly is that the price never changes from NAV. Also, all underlying assets traded separately in very liquid markets. At any time, an investor can choose to liquidate their holdings at the going market price.

The model also enables customization. You can set your own rebalancing period and blacklist any coins you do not want in the index.

Pearson’s Correlation Coefficient:0.98

Despite having an almost identical indexing strategy compared to C20, the HODL20 has a slightly higher correlation coefficient because all underlying assets in the index are tradeable at exactly the market price.

6. CCI30

The CCI30 is an index designed by Igor Riven, professor of mathematics at Temple University. The only way to invest in the CCI30 is the cryptos fund. If you are not an accredited investor or reside in the US, you can not invest in the fund

Indexing Methodology

The CCI30 is a top 30 index. Each coin is weighted by their square root market cap.

Rebalancing Frequency

The index is rebalanced once every month.

Special Considerations

The CCI30 uses an exponentially backed off moving average for market cap, just like the HODL10. The CCI30 also ignores all stablecoins.

Pearson’s Correlation Coefficient:0.99

7. HODL30

Again, the HODL30 is an index offered by HodlBot that is available to non-accredited investors who live anywhere in the world.

Indexing Methodology

The HODL30 is very similar to the CCI30 index. Both indices weigh the individual coins by square root market cap and use an exponentially backed off moving average instead of calculating market cap as an instantaneous number.

Rebalancing Period

The default rebalancing period for the HODL30 is every 28 days. But you can customize this to whatever you’d like.

Special Considerations

The HODL30 and CCI30 use a different constant when calculating the exponentially backed off moving average. The constant used determines how much volatility is “smoothed” out.

Unlike the CCI30, the HODL30 is not a fund. Anyone with a Binance account can instantly trade into the HODL30 for free. Because it is not a fund, you can customize rebalancing frequencies, blacklist any coins you don’t want in the index, and cash out anytime.

Pearson’s Correlation Coefficient:0.99

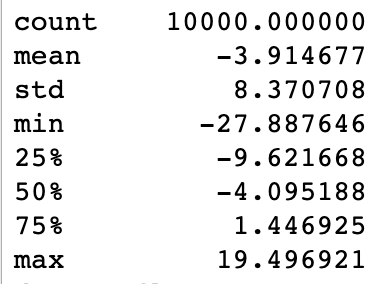

8. CRIX

CRIX is a cryptocurrency index, and not an investable fund. It was made specifically to help investors get a pulse on the cryptocurrency market. It was designed by Humboldt-University’s very own, Dr. Wolfgang Karl Härdle.

Indexing Methodology

The CRIX index does not have a fixed number of constituents. Instead, it includes all assets with an average trading volume higher than the 25th percentile of the market. As of March 28, 2019, the CRIX index contains 55 coins. Every holding is weighted by market cap.

Rebalancing Period

Monthly rebalances are made only to percentage allocations, but not the number of constituents. Every quarter, the number of constituents is re-evaluated.

Special Considerations

The CRIX is a market index that uses Laspeyres derivation to ensure that any changes to the index are solely due to a change in price, and not supply. You can read more about the formula here.

Pearson’s Correlation Coefficient:0.99

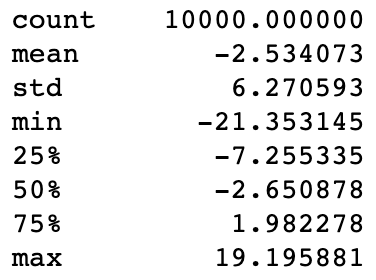

9. Bloomberg Galaxy Crypto Index

The Bloomberg galaxy crypto index is a cryptocurrency index designed by Bloomberg, in partnership with Galaxy Crypto.

The index contains at most, 12 cryptocurrencies ranked by market capitalization. In the index, Bloomberg asserts that no constituent can exceed 30%, or be below 1%.

Rebalancing Frequency

The Bloomberg Galaxy Crypto Index is rebalanced once every month.

Special Considerations

Stablecoins are blacklisted. Only consistent coins with a 30-day median trading volume greater than $2 million are considered. Prices are averaged across Bloomberg-approved pricing sources and is based on the average mid-point between bids and asks.

The Bloomberg Galaxy Crypto Index also uses a Laspeyres derivation to ensure that any changes to the index are solely due to a change in price, and not supply.

Pearson’s Correlation Coefficient:0.99

Create Your Own Index with HodlBot

If none of the indices fit exactly what you’re looking for, you can create your own index with HodlBot. We’ve taken all common indexing methodology and made them available and customizable piece-meal.

- Choose a starting market cap rank and an ending market cap rank. e.g. ranks 20–40. This determines the # of coins in your index.

- Set minimum and maximum percentage caps.

- Select a weighting strategy (even, market cap, square root market cap)

- Backtest your strategy to see how your index would have performed in the past

- Blacklist coins you don’t like

- Customize your rebalancing period.

Why Invest in a Cryptocurrency Index Fund?

Index funds > 80% of professional traders:

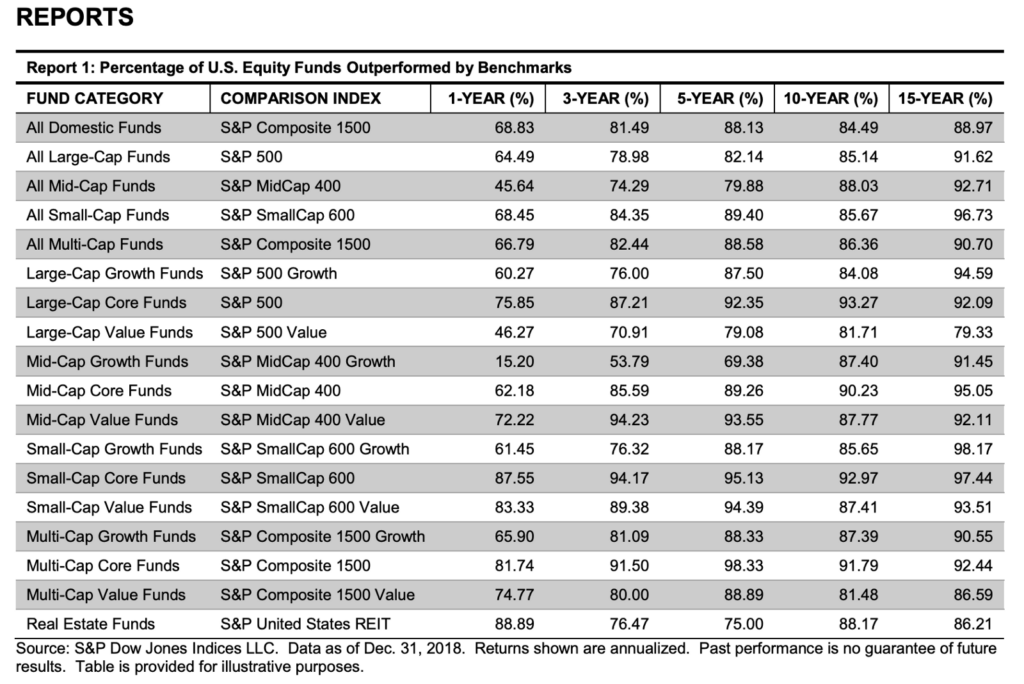

According to the 2018 SPIVA U.S. Scorecard, 80% or more of active managers across all categories underperformed their respective indices.

While short-term results were more comparable, active managers were not able to keep up over the long-run. This is why Warren Buffet famously bet and won $1 million dollars for predicting that the S&P500 index would beat a collection of a Protégé Partners hedge funds over the course of 10 years.

It’s easier to get lucky over the short-term, and harder to get lucky over the long-run.

If professional active managers can’t do it, imagine how difficult it is for the average retail investor. Even if we completely ignored the information and skill discrepancy, retail investors are at a disadvantage because they do not have nearly as much time to spend on researching investments. Most retail investors consider trading a hobby, and not their occupation.

As a side note, because long-run outperformance is so difficult, you should also approach crypto trader gurus with a healthy dose of skepticism. If we can use equity markets as a point of reference, most “expert traders” will lose to an index over the long-run. They might get lucky in the short run, and use that to build up their credibility. Don’t be fooled. Outperformance in the short-run is not very impressive and does not guarantee long-term outperformance.

Obviously, the stock market is not the same as the cryptocurrency market. But I wager that in the cryptocurrency market, it may be even more difficult to beat index funds. Consider the fact that the cryptocurrency market is rampant with market manipulators, insider traders, and pump & dumpers, all looking to rip off the little guy.

Index Funds Are Low Cost & Low Maintenance

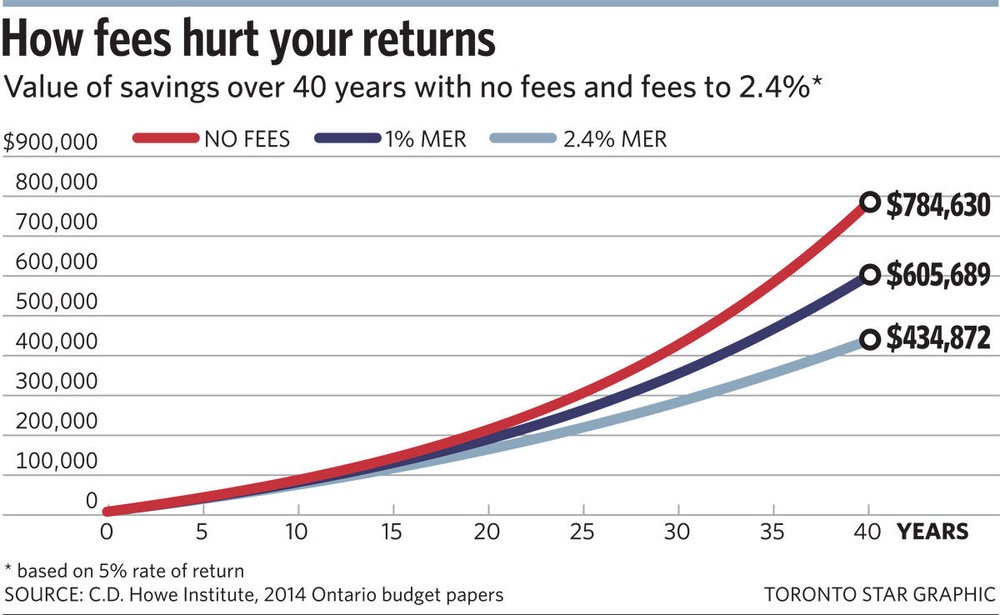

Indices use a rules-based, transparent methodology to determine their portfolio constituents ahead of time. Therefore they are very cheap to create and maintain as they do not incur high management fees.

If your portfolio is being managed by someone else, you’re likely to incur a very high management fee. Management fees may seem trivial in the short-run, but over the long-run, they severely impact your returns.

If you’re managing your portfolio yourself, don’t make the mistake of thinking that it’s free. There is an implicit opportunity cost when you are actively managing your portfolio. Time isn’t free. Hours spent trading a week can quickly rack up.

Rather than worrying about trades, rebalances, and market timing, index funds require very minimal work. After the initial set-up, you won’t have to touch it again until it’s time to withdraw funds.

Most index funds handle portfolio rebalances automatically under the hood. For example, at HodlBot we enable investors to create their own personal index fund and handle all portfolio rebalances for them automatically on a fixed, customizable schedule.

Diversify Your Risk — Most Coins Go to Zero:

With respect to emerging technologies, it’s very common for a single asset to significantly outperform another. Out of a pool of 100 investments, one might 1000x, while the others go to zero. Emerging tech investments like cryptocurrencies tend to follow a power law distribution.

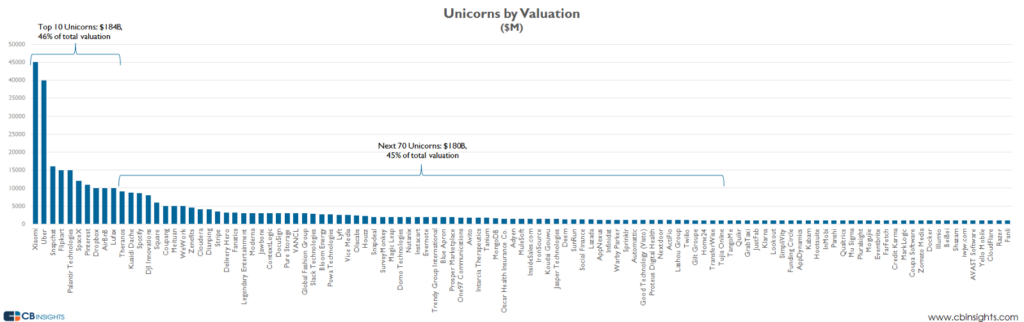

A study by CBInsights found that the top 10 most valued tech unicorns were valued higher than the next 70.

If we look at today’s market cap for cryptocurrencies, the combined market cap of the top 20 coins makes up 89% of the entire market. Assuming returns in the cryptocurrency market also follow a power law distribution, we can expect that a few coins will net colossal returns, while others perish.

That’s why it’s so important to diversify. You must shield your portfolio against catastrophic failures, and improve your odds of picking a winner.

In classical finance, the two kinds of portfolio risk are classified as:

- Systematic risk — The inherent risk of participating in a market (i.e. investing in the cryptocurrency market)

- Unsystematic risk — The risk an investor brings upon themselves when picking an individual asset (i.e. picking a coin).

Systematic market risk is inescapable, but unsystematic risk is a choice. In my opinion, most investors don’t benefit from taking on unsystematic risk. As aforementioned, most active traders who take on unsystematic risk, fail to beat the market in the long-run.

That is to say, if you’re as confident in the crypto market as I am, then it is wiser to bet your money on the entire cryptocurrency market rather than test your luck picking individual coins.

I know that the asset class will grow, but I don’t know who the winners will be.

Letting Your Winners Run & Selling Coins that are on its Death Spiral

One of the biggest dangers to traders is sunk cost bias and fear of loss.

“I can’t sell at a loss. I’m waiting for the coin to bounce back. I might even double down” — Anonymous Trader #253

As we mentioned before, if cryptocurrency market returns follow a power-law distribution, then most coins are going to go to zero. If you stubbornly hold them, or worse, double down as they go to zero, you’ll lose quite a lot of capital along the way.

Comparatively, a total market index is resistant towards catastrophic failure and sunk cost bias. If a coin goes to zero, the index will get rid of it.

Imagine if you’re holding an index of the top 30 coins by market cap. If a coin drops out of the top 30, you’ll sell it on the next scheduled rebalancing period, and replace it with the new one that has taken its place. Index investors will not be stuck with dead coins.

For this reason, index funds have some of the characteristics of a momentum based strategy. With the risk of over-simplifying, a momentum strategy beckons you to increase your holdings as prices move up, and decrease your holdings as prices move down.

Why Do You Care About Indices So Much?

I’m the founder of HodlBot.

We made a tool that makes it super easy for everyday cryptocurrency investors to index the market. We created the HODL10, HODL20, and HODL30 indices. You can get set-up with one of the HODL indices in an instant. Or you can create your own custom index.